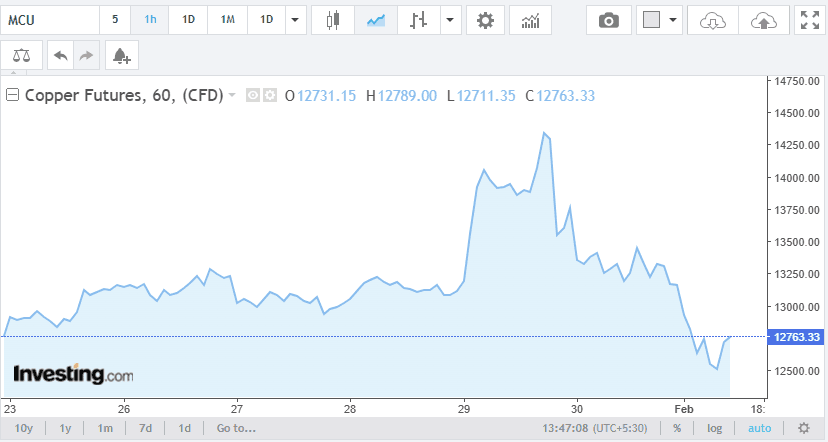

Today’s Copper Price:

Is Copper Going to Fall or Rise Again? Is This the Right Time to Invest in Copper?

Copper prices have been extremely volatile in recent weeks, leaving investors and businesses asking important questions: Why is copper price falling today? Will copper prices drop further? Or is this a good buying opportunity before the next rally?

After touching record highs on the London Metal Exchange (LME), copper has seen a sharp correction. This article breaks down today’s copper price trend, the reasons behind the fall, and whether copper can rise again in the near and long term.

Today’s Copper Price (Approx.)

LME Copper: ~$9,600 per tonne

Per kg: ~$9.6/kg

India (MCX / physical reference): ~₹1,280 per kg

Today’s Copper Price Trend (LME Overview)

Copper recently surged to historic highs on the LME, driven by strong speculative interest, supply concerns, and expectations of long-term demand from electrification and renewable energy. However, prices have since pulled back sharply, reflecting profit-taking and global macroeconomic pressures.

Key takeaway:

Why Is Copper Price Falling Today?

Several factors have contributed to the recent decline in copper prices:

1. Profit Booking After Record Highs

After copper reached multi-year and all-time highs, traders and institutional investors booked profits. This is a normal market behavior after a sharp rally and often leads to short-term price corrections.

2. Stronger US Dollar

Copper is traded globally in US dollars. When the dollar strengthens, commodities like copper become more expensive for other currencies, reducing demand and pushing prices lower.

3. China Demand Concerns

China is the world’s largest consumer of copper. Any slowdown in Chinese construction, infrastructure, or manufacturing activity impacts copper prices directly. Recent demand signals from China have been mixed, creating uncertainty in the market.

4. Broader Commodity Market Weakness

Copper prices often move with global commodity sentiment. Recent sell-offs across metals and energy markets have added pressure on copper prices.

Is Copper Price Going to Drop Further?

Short-Term Outlook

Yes, copper prices can still fall in the short term due to:

Ongoing global economic uncertainty

Currency fluctuations

Weak short-term demand data

Short-term traders should expect price swings and volatility.

Medium to Long-Term Outlook

A major collapse looks unlikely unless there is:

A severe global recession

A sharp and prolonged slowdown in China

Corrections are part of healthy commodity cycles, especially after strong rallies.

Why Copper Prices Can Rise Again

Despite recent weakness, several strong long-term drivers support copper prices:

1. Structural Supply Constraints

Limited new copper mines

Declining ore grades

Long timelines for new projects

Copper supply cannot increase quickly, creating long-term price support.

2. Electric Vehicles & Renewable Energy Demand

Copper is critical for:

Electric vehicles

Charging infrastructure

Solar and wind power

Power grids and data centers

The global energy transition is copper-intensive, and demand is expected to grow steadily.

3. Low Global Inventory Levels

At various points during the rally, copper inventories on exchanges like the LME and SHFE remained relatively low, indicating tight physical supply.

Is This the Right Time to Invest in Copper?

For Short-Term Investors

Copper may remain volatile. Short-term investments should be made with:

Clear entry and exit levels

Risk management strategies

Awareness of macroeconomic events

For Long-Term Investors

For long-term investors, current price corrections may offer accumulation opportunities rather than reasons to exit.

Many analysts believe copper remains one of the most important strategic metals for the next decade due to electrification and infrastructure growth.

Will Copper Price Rise Again in 2026 and Beyond?

Most market experts agree on one point:

📈 Copper’s long-term story is still bullish, even if short-term volatility continues.

Future price movement will depend on:

US interest rate policy

Strength of the US dollar

China’s industrial growth

Global infrastructure spending

Mining supply disruptions

Conclusion: Today’s Copper Price, Market Outlook & What Investors Should Do

Copper prices are currently at a critical turning point. After reaching record highs on the London Metal Exchange, the metal has entered a phase of correction driven by profit booking, a stronger US dollar, and short-term demand concerns—especially from China. This has raised understandable questions among investors and businesses about whether copper prices will fall further or rise again.

In the short term, copper prices may remain volatile. Market sentiment is being influenced by global macroeconomic factors such as interest rate expectations, currency movements, and economic data from major consuming regions. As long as uncertainty around global growth and China’s industrial demand persists, copper prices can experience further corrections or sideways movement. Short-term investors should be prepared for sharp price swings and avoid chasing momentum without proper risk management.

However, when we zoom out and look at the medium to long-term picture, the fundamentals of copper remain strong. Copper is not just another industrial metal—it is a strategic commodity at the heart of global electrification, renewable energy expansion, electric vehicles, power transmission, and infrastructure development. Demand from these sectors is expected to grow steadily over the coming years.

At the same time, copper supply growth remains limited. New mining projects take years to develop, ore grades are declining, and capital investment in mining has not kept pace with future demand. These structural supply constraints mean that even moderate increases in demand can quickly tighten the market and push prices higher again.

For long-term investors, the current price correction can be viewed as an opportunity rather than a warning sign. Gradual accumulation during periods of weakness may offer better risk-reward compared to buying at market peaks. For businesses and industrial users, price dips can provide chances to hedge future requirements more efficiently.

So, is this the right time to invest in copper?

The answer depends on your time horizon. Short-term traders should remain cautious, but long-term investors who believe in the global energy transition and infrastructure growth may still find copper to be an attractive asset.

Will copper prices rise again?

While no market moves in a straight line, the long-term outlook suggests that copper prices are likely to recover and potentially move higher over time—supported by strong demand fundamentals and limited supply growth.

Mahaveer Electrical

Coimbatore

Dealer of Submersible Winding wire, motor and pumps spares and capacitor.